Introduction

The healthcare sector is evolving rapidly, driven by digital innovation, shifting consumer preferences, and breakthroughs in pharmaceuticals. Two companies at the forefront of these trends are Hims & Hers Health, Inc. (HIMS), a leader in telehealth and wellness, and Novo Nordisk A/S (NVO), a global pharmaceutical powerhouse known for its diabetes and obesity treatments. This article provides a comparative overview of “hims stock” and “novo nordisk,” analyzing their business models, stock performance, growth prospects, and what investors should consider in today’s dynamic market.

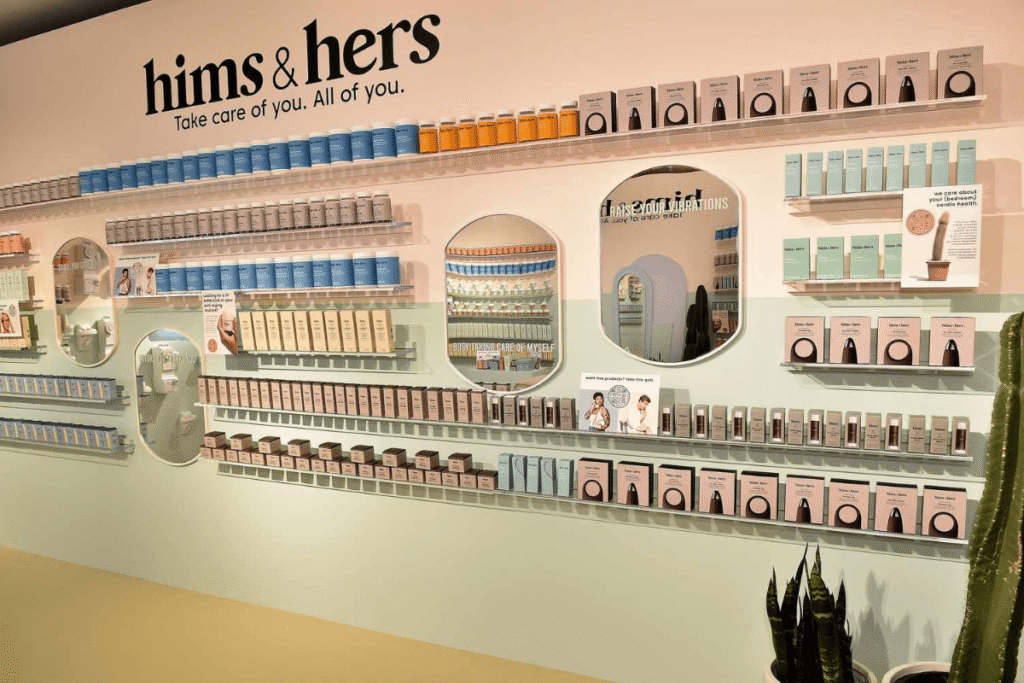

Hims & Hers Health, Inc. (HIMS)

Business Model and Market Focus

Hims & Hers Health, Inc. operates a direct-to-consumer telehealth platform, offering affordable and accessible healthcare solutions for both men and women. The company’s services include:

- Prescription and over-the-counter medications for sexual health, hair loss, mental health, and skincare

- Virtual medical consultations and personalized treatment plans

- Subscription-based wellness products and telemedicine services

With a mission to normalize health and wellness challenges, Hims & Hers targets younger, tech-savvy consumers seeking convenience and discretion in their healthcare journeys. The brand’s dual focus on “hims and hers” ensures it appeals broadly across gender lines, expanding its addressable market.

HIMS Stock Performance and Financials

- Current Price (April 29, 2025): $28.48 per share

- 1-Year Return: +127.17%

- 3-Year Return: +558.43%

- 2024 Revenue: $1.5 billion (up 69.33% YoY)

- 2024 Net Income: $126 million, with an 8.54% net profit margin.

- Free Cash Flow: $209 million, 14% FCF margin.

Recent technical analysis shows HIMS stock has experienced volatility, with a 9.92% daily range and 84.65% 52-week volatility. While the sentiment is currently neutral, analysts highlight the company’s explosive growth and improving profitability as key strengths.

Growth Prospects and Risks

Growth Drivers:

- Expanding telehealth adoption post-pandemic

- New product launches and strategic acquisitions

- Data-driven personalization and high customer retention

Risks:

- Intense competition from other telehealth and digital health platforms

- Regulatory uncertainties in telemedicine

- High customer acquisition costs and ongoing investment in technology

Hims & Hers’ ability to innovate and personalize care positions it as a disruptive force in healthcare, but the sector’s rapid evolution means agility and execution remain crucial.

Novo Nordisk A/S (NVO)

Business Model and Market Focus

Novo Nordisk is a global leader in pharmaceuticals, specializing in diabetes care, obesity management, and treatments for other chronic conditions. Its flagship products, such as Ozempic and Wegovy, have revolutionized diabetes and weight management, driving strong demand worldwide.

The company’s focus extends to:

- Research and development of GLP-1 agonists and insulin therapies

- Expansion into cardiovascular and rare disease treatments

- Leveraging economies of scale and efficient manufacturing

Novo Nordisk’s established reputation, robust pipeline, and global reach make it a cornerstone in the healthcare investment landscape.

NVO Stock Performance and Financials

- Current Price (April 29, 2025): $62.70 per share

- 2025 Price Forecast: $67.07 (+7.2%)

- Market Cap: ~$313 billion

- 1-Year Trend: Stock has shed over 50% from its 2024 peak but is forecasted to rebound with continued demand for Ozempic and Wegovy

- Growth Outlook: 14% top-line and 16% bottom-line growth expected through 2029

Despite recent volatility, NVO stock is considered undervalued by some analysts and remains a favorite for exposure to the booming diabetes and obesity drug markets.

Growth Prospects and Risks

Growth Drivers:

- Blockbuster drugs (Ozempic, Wegovy) with expanding indications

- Strong R&D pipeline and patent protection through 2032.

- Growing global prevalence of diabetes and obesity

Risks:

- Pricing pressure from government and insurers, especially in the US

- Patent expirations and generic competition

- Regulatory changes affecting drug reimbursement

Novo Nordisk’s wide economic moat, built on innovation and scale, helps shield it from many risks, but ongoing policy shifts and competition from peers like Eli Lilly remain challenges.

Comparison and Investment Considerations

Industry and Market Trends

- Hims & Hers: Rides the wave of telehealth adoption, digital health innovation, and consumer demand for convenience and privacy.

- Novo Nordisk: Benefits from demographic trends (aging, rising chronic disease), medical innovation, and global healthcare spending.

Growth Potential

- HIMS: High growth trajectory with significant upside, especially if it continues to expand its product suite and customer base.

- NVO: Stable, long-term growth supported by blockbuster drugs and a robust R&D pipeline.

Financial Stability

- HIMS: Rapid revenue growth, improving profitability, but higher volatility and risk typical of newer, disruptive companies.

- NVO: Strong balance sheet, consistent cash flow, and large market cap, offering more stability.

Risk Factors

- HIMS: Regulatory risk, competition, execution on growth strategy.

- NVO: Pricing pressure, patent cliffs, regulatory changes.

Portfolio Fit

- HIMS: Suitable for growth-oriented investors comfortable with volatility and sector disruption.

- NVO: Fits well in diversified portfolios seeking stable, defensive healthcare exposure with growth potential.

Future Outlook

Looking ahead, both Hims & Hers and Novo Nordisk are well-positioned to capitalize on industry trends:

- Hims & Hers: Continued telehealth adoption, expansion into mental health and wellness, and potential international growth could drive further gains. Regulatory clarity and successful execution will be key.

- Novo Nordisk: Ongoing innovation in diabetes, obesity, and cardiovascular care, plus expansion into new therapeutic areas, support long-term growth. Watch for developments in drug pricing policy and patent protection as pivotal factors.

Technological advancements, shifting consumer preferences, and evolving regulations will shape the trajectory for both companies. Investors should monitor earnings reports, product launches, and industry news for signals on future performance.

Conclusion

Both Hims & Hers (HIMS) and Novo Nordisk (NVO) offer compelling-but distinct-investment opportunities in the healthcare sector. Hims & Hers stands out for its rapid growth and disruptive approach to telehealth and wellness, appealing to investors seeking high upside and innovation. Novo Nordisk, with its established leadership in diabetes and obesity treatments, offers stability and long-term growth potential, especially as demand for its blockbuster drugs remains strong.

For investors, the choice between “hims stock” and “novo nordisk” depends on individual risk tolerance, investment goals, and views on the future of healthcare. A balanced portfolio might include exposure to both, capturing the dynamism of digital health and the resilience of pharmaceutical giants.

Also Read- https://scoopusa24.com/amazon-tariffs-impact-analysis/