Leadership Shake-Up Shocks Investors

UNH stock took a major hit today, May 13, 2025, after UnitedHealth Group announced the sudden exit of CEO Andrew Witty. Witty stepped down for personal reasons, effective immediately, and was replaced by Stephen Hemsley, who previously led the company from 2006 to 2017. Hemsley, also the current chairman, returns to the CEO role during a turbulent time for the healthcare giant.

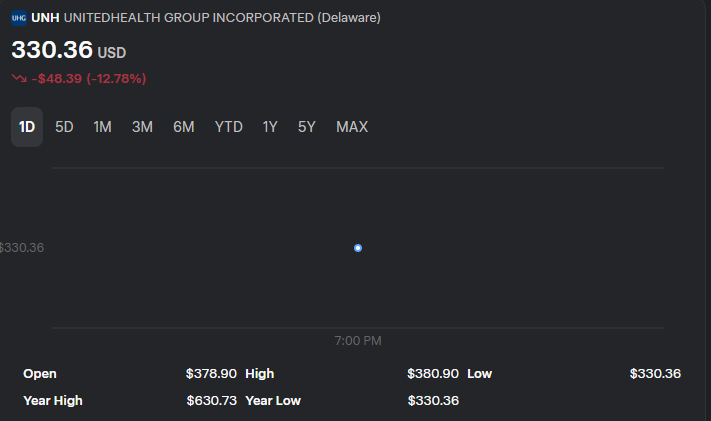

The news triggered a sharp decline in UnitedHealth’s stock price. UNH closed at $330.36, down 12.82% from its previous close of $378.75, marking its lowest point this year. This drop aligns with premarket reports of a 7–10% decline, reflecting investor unease over the leadership change and the company’s suspended 2025 outlook.

Why Did Andrew Witty Step Down?

Andrew Witty’s departure comes after a challenging tenure. Since taking over as CEO in 2021, Witty navigated UnitedHealth through a cyberattack in 2024 that disrupted the U.S. healthcare system and the tragic murder of executive Brian Thompson in December 2024. Despite these hurdles, the company saw a 60.5% stock increase under his leadership until recent setbacks.

Witty will remain as a senior adviser to Hemsley. In a statement, he called leading UnitedHealth “a tremendous honor,” emphasizing the team’s daily efforts to improve the health system. However, rising medical costs and a tough 2025 outlook likely contributed to his exit, raising questions about internal pressures.

Stephen Hemsley’s Return: A Steady Hand?

Stephen Hemsley, often referred to as Steve Hemsley, brings familiarity to the role. Having served as CEO for over a decade, he led UnitedHealth to significant growth, achieving a long-term growth target of 13–16%. Hemsley expressed gratitude for Witty’s stewardship, noting his leadership during “challenging times.”

Hemsley aims to return UnitedHealth to growth in 2026. However, the company suspended its 2025 forecast due to surging medical costs, particularly in Medicare Advantage plans, and higher care activity across benefit offerings. This uncertainty has fueled investor concerns, contributing to the stock’s decline.

UNH Stock Performance: A Steep Decline

UNH stock has seen a dramatic fall. Over the past month, the stock dropped 43.8%, from $587.95 on April 14 to $330.364 today. Over the past year, it’s down 33.3%, from $495.37 in May 2024 to $330.36, a stark contrast to its yearly high of $630.73. The company’s market cap now stands at $367.22 billion.

The stock’s 12.82% daily drop is the worst since March 2021, driven by the leadership change and suspended outlook. Posts on X reflect investor unease, with users noting the “uncertainty” surrounding UNH’s future. Some analysts, however, see Hemsley’s return as a stabilizing factor, given his past success.

Challenges Facing UnitedHealth Group

UnitedHealth Group faces multiple challenges. Rising medical costs, especially for Medicare Advantage beneficiaries, have strained finances. The company also lowered its profit forecast last month to $24.65–$25.15 per share, down from $29.50–$30.00, citing increased care activity and Medicare funding cuts.

The past year has been tumultuous, with the 2024 cyberattack affecting 200 million Americans and Thompson’s murder sparking public backlash against the U.S. healthcare system. UnitedHealth spent $1.7 million on executive security in 2024, highlighting the heightened risks faced by its leadership.

What’s Next for UNH Stock?

The future of UNH stock hinges on Hemsley’s ability to navigate these challenges. His focus on returning to 13–16% growth by 2026 offers hope, but the suspended 2025 outlook signals near-term hurdles. Investors will watch closely for updates on medical cost management and strategic shifts under Hemsley’s leadership.

Market sentiment remains cautious. While some see the stock’s current price as a buying opportunity, others worry about ongoing volatility in the healthcare sector. UnitedHealth’s role as the nation’s largest health insurer, serving over 49 million people, underscores its importance, but restoring investor confidence will be key.

See also https://scoopusa24.com/china-tariffs-2025-us-trade-deal-switzerland/