A Stellar Day for SMCI Stock

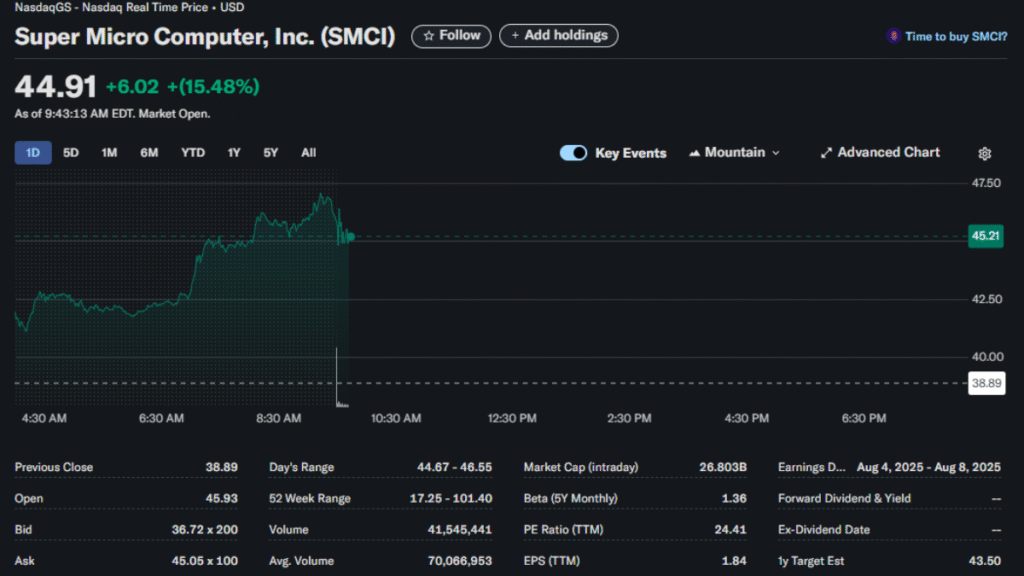

SMCI stock surged 16% on May 13, 2025, closing at $45.129 per share, according to real-time financial data. This marks a significant rebound for Super Micro Computer, Inc. (NASDAQ:SMCI), driven by two major catalysts: the U.S.-China tariff de-escalation and a newly announced $20 billion partnership with Saudi data center firm DataVolt. After a rocky start to 2025, SMCI is gaining momentum, and investors are taking notice.

The stock opened at $41.987, hit a high of $47.094, and dipped to a low of $41.52 during the trading session. This 16% daily gain from its previous close of $38.89 reflects renewed confidence in SMCI’s position in the AI and tech sector, especially as global trade tensions ease.

U.S.-China Tariff Deal Sparks Rally

The U.S. and China agreed on May 12, 2025, to slash tariffs for 90 days, dropping the U.S. tariff rate on Chinese imports to 30% and China’s duties on U.S. imports to 10%. This de-escalation, following negotiations in Switzerland, has calmed fears of a tariff-induced global recession. Tech stocks, including SMCI, have been major beneficiaries, as the intertwined U.S.-China tech supply chain faced significant strain from earlier trade policies.

SMCI, a key player in AI server manufacturing, relies heavily on components sourced globally, including from China. The tariff relief reduces costs for SMCI’s supply chain, potentially boosting margins that had been squeezed to 9.7% in Q3 2025. The broader market rally—highlighted by the Dow soaring 1,000 points and tech giants like Nvidia jumping nearly 6%—further fueled SMCI’s upward momentum. Investors see this as a sign that SMCI can regain its footing after a challenging year.

$20 Billion DataVolt Partnership Boosts Confidence

On May 14, 2025, SMCI announced a multi-year, $20 billion partnership with DataVolt, a Saudi-based data center firm. This deal, reported by Investing.com, positions SMCI to supply AI-optimized servers and storage solutions for DataVolt’s expanding infrastructure. With artificial intelligence platforms already accounting for 70% of SMCI’s sales, this partnership underscores the company’s leadership in the AI sector—a point emphasized by Raymond James analysts who initiated coverage with a Buy rating and a $41 price target.

The DataVolt deal comes at a critical time. SMCI’s Q3 2025 earnings, released on May 7, missed Wall Street expectations with revenue of $4.6 billion against $5.42 billion forecasted, and an EPS of $0.31 versus $0.50 expected. The company cited economic uncertainty, tariffs, and delays in Nvidia’s Blackwell GPU transitions as reasons for the shortfall. However, the DataVolt partnership signals long-term growth potential, boosting investor sentiment and contributing to the 16% stock spike.

SMCI Stock Performance: A Volatile Year

SMCI stock has been a rollercoaster in 2025. Real-time data shows it’s up 37.2% over the past month, climbing from $32.9 on April 14 to $45.129 on May 14. However, it’s still down 42.5% year-over-year, having started May 2024 at $78.451. The stock hit a yearly high of $101.402 but fell to a low of $17.25, reflecting volatility driven by tariff fears, Q3 earnings misses, and competitive pressures in the AI server market.

Despite the annual decline, SMCI’s market cap now stands at $19.66 billion, and its forward P/E ratio of around 9x—based on fiscal 2026 estimates—suggests the stock is undervalued. Analysts from Seeking Alpha and Yahoo Finance have called SMCI a “strong buy,” citing its attractive valuation and robust positioning in AI and high-performance computing markets. The company’s leadership in liquid-cooled data center technology further strengthens its appeal as a long-term investment.

Market Sentiment: Optimism with Caution

Market sentiment around SMCI stock is optimistic but cautious. The U.S.-China tariff pause has alleviated immediate concerns, but structural trade issues remain unresolved. Posts on X reflect a divide—some users see SMCI as a “hidden gem” in the AI space, while others worry about its low-margin business model and lack of a competitive moat. One user noted, “SMCI’s DataVolt deal could be a game-changer,” while another cautioned, “Margins are still a problem.”

Analysts are more bullish. Raymond James highlighted SMCI’s AI-optimized infrastructure, while Seeking Alpha pointed to potential margin expansion by the end of FY2025. However, SMCI’s history of slashing guidance—first in November 2024 and again in Q3 2025—keeps some investors wary. The company’s aggressive $40 billion revenue target for 2026, set by CEO Charles Liang, remains under scrutiny given current economic conditions.

What’s Next for SMCI Stock?

The future of SMCI stock hinges on several factors. The DataVolt partnership and tariff relief provide a strong foundation for growth, but SMCI must address margin pressures and competition from other AI server makers. Its reliance on Nvidia GPUs, which faced delays in 2024, remains a risk, though Nvidia’s recent shipment of 18,000 AI chips to Saudi Arabia signals a strengthening supply chain that could benefit SMCI.

If SMCI can capitalize on its AI leadership and improve profitability, it could reclaim its yearly high of $101.402. For now, the stock’s undervaluation and recent momentum make it an attractive option for risk-tolerant investors. As the tech sector continues to rebound, SMCI is well-positioned to ride the wave—but it must navigate ongoing challenges to sustain its upward trajectory.

See also https://scoopusa24.com/unh-stock-andrew-witty-stephen-hemsley-return/